by providing an incredibly valuable resource for both consumers and financial advisors alike.” TTV Capital Partner Mark Johnson said the company “is quickly expanding its lead in one of the largest markets in the U.S. The funding and its flashy valuation comes with a certain weight, even in the growing world of unicorn companies. The company claims that, with today’s news, co-founder Michael Carvin now becomes the third Black founder and CEO of a company valued at over $1 billion. Others include Compass CEO and founder Robert Reffkin, whom we recently profiled here, and Calendly CEO and founder Tope Awotona, who we have also profiled. While exciting, the unfortunate rarity of Black-led unicorns is a symptom of historical underfunding in Black or African-American startup founders. Crunchbase estimates that in 2020, 1% of total venture capital funding, or $1 billion, went to this cohort of founders.

New yorkbased smartasset 110m ttv 1b mac#

“I hope seeing more successful Black founders inspires more people of color to start companies so that one day this is not news,” Carvin told TechCrunch.Ī number of Black-led venture capital firms have closed investments in the past year, which could change this number, including Collab Capital’s $50 million investment vehicle, Harlem Capital, which closed a $134 million seed fund earlier this year Cleo Capital, which set a $20 million target for Fund II and MaC VC, which landed $103 million for its inaugural fund. HBCUvc and Google for Startups also announced this month two separate efforts to provide non-dilutive capital to early-stage, underrepresented founders.

New yorkbased smartasset 110m ttv 1b series#

With a Series D under its belt, SmartAsset is working on taking out the bias from personal finance – while it itself is a case study in how overlooked founders, which routinely suffer from this exact phenomenon, continue to lead strong businesses.Fintech startup company SmartAsset announced today it raised $110 million in a Series D business funding round led by TTV Capital. New Funding and Partnership to Help Fuel Sustainable Growth Other business investors that took part in the funding round are Javelin Venture Partners, Contour Venture Partners, Citi Ventures, Life Ventures, North Bridge Venture Partners, and CMFG Ventures.

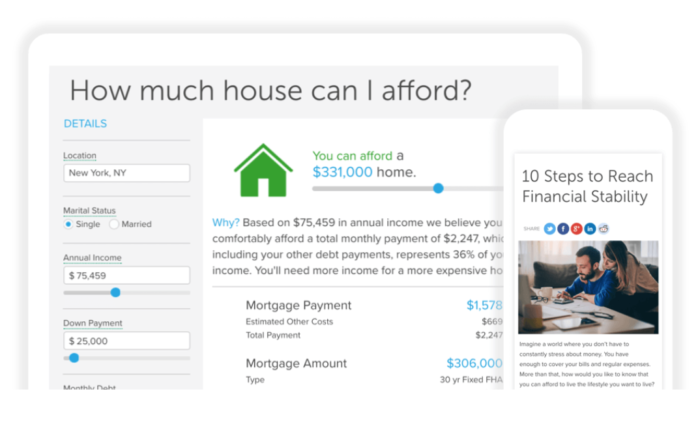

New funding takes SmartAsset’s business valuation to the unicorn territory at more than $1 billion. Before this, the New York-based startup company last raised funds in June 2018, and the company’s revenue has grown by 10x since then, with nearly $100 million in annual recurring revenue (ARR). The Series D funding comes after the startup company partnered up with LPL Financial and the launch of its Live Connections solution. Through its personal finance tools and personalized calculators, the fintech startup reaches over 100 million people on a monthly basis. Moreover, financial advisors and companies on its SmartAdvisor platform accumulate $1.5 billion in new, closed assets under management (AUM) each month. “Our mission is to help people get better financial advice.

0 kommentar(er)

0 kommentar(er)